An Employee’s Review of Telecommuting

August 18, 2018Let Your Job Sponsor Your Life

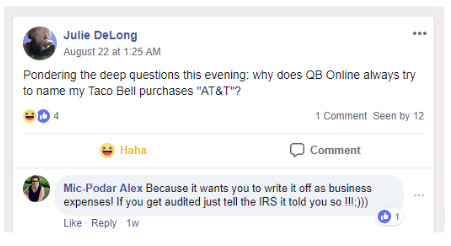

October 9, 2018I hopped on Facebook the other day and saw this query, posed by bookkeeper extraordinaire Julie DeLong:

Julie: “Pondering the deep questions this evening: why does QB Online always try to name my Taco Bell purchases “AT&T”?”

Alex: “Because it wants you to write it off as business expenses! If you get audited just tell the IRS it told you so!!!;)))”

Imagine trying to explain to an Auditor why your phone bill smells like hot sauce! As I laughed about it, and about Alex’s response; I realized the problem we face as we advance as a society is Artificial Intelligence can only be as smart as its creators-the human race. I haven’t met a person yet who is entirely mistake free, so we find “glitches” in the programs we write. Glitches that can cause serious problems if we let them continue; like telling the IRS that Taco Bell is indeed your phone company. I don’t think they’ll buy it.

What’s the solution? Fortunately, in this case, it’s as simple as actually spending some time reconciling your accounts. *cue the bookkeepers* That’s what we’re here for. The convenience of having your accounts tied to your bookkeeping software does not eliminate the need for a “second pair of eyes” to make sure everything is put in its correct place. It just makes it more convenient.

Here at Backyard Bookkeeper, we stay on top of the newest bookkeeping software development and are excited for whatever is next. Domo Arigato, Mr. Roboto. Thank you for making our job easier, but not irrelevant.