Blog

December 27, 2024

Published by Julie on December 27, 2024

Categories

I was shocked and sorry to hear about Bench Accounting shutting down today, but I can’t say I’m particularly surprised. They are not the only company […]

April 30, 2024

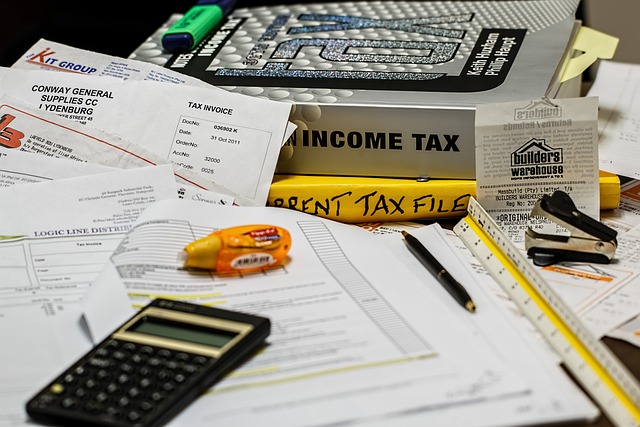

Is your bookkeeping a mess? Have other bookkeeping experts thrown up their hands, declaring they can’t reconcile your books? Backyard Bookkeeper also specializes in cleanup projects […]

April 30, 2024

What if your bookkeeping needs don’t necessitate a standard package but don’t fit anywhere else either? Many business owners just need a little training, temporary help […]

April 30, 2024

If you’re not sure what a 1099 is—let alone what should be on it or who needs to get one from you—don’t panic; you’re not alone. […]

April 12, 2024

Published by Alex on April 12, 2024

Categories

Your bookkeeper should be your right hand in your business. Here’s why: In today’s fast-paced business world, having a reliable and competent bookkeeper is essential for […]

April 3, 2024

Published by Alex on April 3, 2024

Categories

The Future of QuickBooks Desktop: Finding the Right Solution for Your Business We have warned about this for the past five years but no one believed […]

March 14, 2024

Need an on-site specialist to handle real-time invoicing or bill payment? As much as we love to provide exceptional bookkeeping services for our clients, we understand […]

March 14, 2024

Published by Alex on March 14, 2024

Categories

Don’t have the resources for a full-time financial executive? No need to worry. We are your trusted accounting partners. Backyard Bookkeeper is pleased to offer fractional […]